15+ wa liquor tax calculator

Find out with the wa liquor tax calculator. Beer Federal Tax Calculator.

Tax Calculator

Calculate total liquor cost in all 50 states without going to the register.

. Washingtons general sales tax of 65 also applies to the. The tax rate for sales to consumers is 205 percent. Quickly calculate the total price including sales tax and volume tax of liquor sold in the state of washington in as little as four taps.

Washingtons general sales tax of 65 also applies to the. If you sell spirits you will. Find out with the wa liquor tax calculator.

Download Washington State Liquor Tax Calculator App 221 for iPad iPhone free online at AppPure. You have to enter a decimal number with dollars and cents ya jack-tard. List price is 90 and tax percentage is 65.

This simple app does one thing -- lets you input the price and size of the bottle of liquor and then it tells you the total cost. Multiply price by decimal. Washington state liquor tax calculator free quickly calculate the total price including sales tax and volume tax of liquor sold in the state of washington in as little as four taps.

The state has some of the highest sales taxes in the country though. Get Washington State Liquor Tax Calculator for iOS latest version. Control State Spirits The Alabama beer excise tax was last changed in 1969 and has lost 83 of its value.

WA Liquor Tax Calculator. Since spirits purchases made by licensed on-premises. The tax rate for consumers is 37708 per liter.

Select State DC or US. 350barrel applies to the first 60000 barrels for a domestic brewer who produces less than 2 million barrels per year. How do I pay the tax.

Washington has no personal income tax. Washington State Alcohol Tax Calculator. Find out with the WA Liquor Tax Calculator.

While the privatization did. The tax rate for on-premises retailers such as restaurants bars etc is 24408 per liter. Divide tax percentage by 100.

Washington property taxes rank in the middle when compared to other states. From the drop down menu. 65 100 0065.

If the tax had. WA Liquor Tax Calculator. Washington Wine Tax - 087 gallon Washingtons general sales tax of 65 also applies to the purchase of wine.

Washington State Liquor Tax Calculator. The price of the coffee maker is 70 and your state sales tax is 65. In Washington wine vendors are responsible for paying a state excise tax of.

The tax rate for sales to consumers is 205 percent The tax rate for on-premises retailers such as restaurants bars etc is 137 percent. Washington recently privatized liquor sales and with it came a new pricing structure for liquor. Washington State Alcohol Tax Calculator Vecheinfo 15.

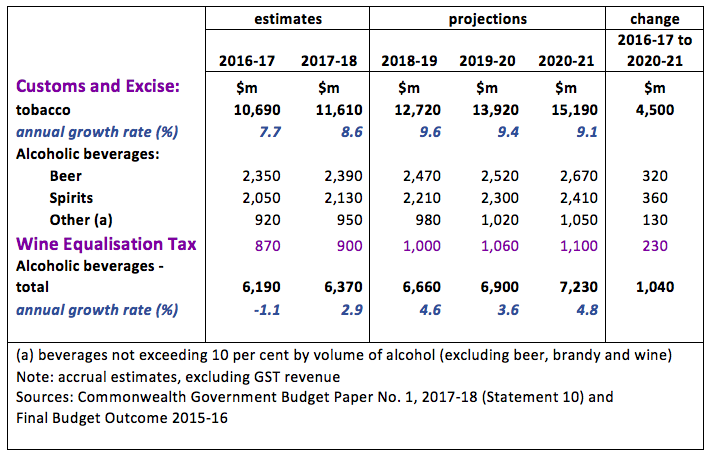

Effects Of Changes To The Taxation Of Beer On Alcohol Consumption And Government Revenue In Australia Sciencedirect

Tobacco And Alcohol A Taxing Double Standard Austaxpolicy The Tax And Transfer Policy Blog

Eu Excise Duty On Alcohol Distilled Spirits Taxes In Europe 2021

Bottle Tax

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

Gendered Taxes The Interaction Of Tax Policy With Gender Equality In Imf Working Papers Volume 2022 Issue 026 2022

Washington State Liquor Tax Apps On Google Play

Underage Access To Alcohol And Its Impact On Teenage Drinking And Crime Sciencedirect

Washington Income Tax Calculator Smartasset

![]()

Washington State Liquor Tax Calculator By Frank Schmitt

Azerbaijan Total Alcohol Consumption Per Capita Liters Of Pure Alcohol Projected Estimates Aged 15 Economic Indicators Ceic

Washington State Liquor Tax Apps On Google Play

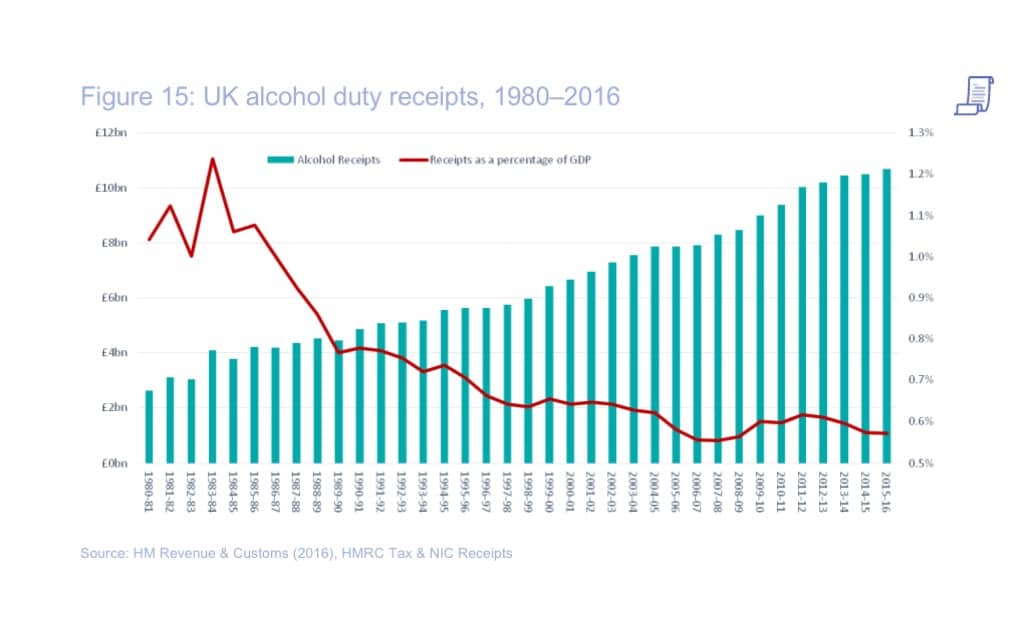

Pros And Cons Of Higher Tax On Alcohol Economics Help

Washington Sales Tax Calculator And Local Rates 2021 Wise

How Does The Grocery Store Calculate Tax On My Items Quora

Pdf Minimum Pricing Of Alcohol Versus Volumetric Taxation Which Policy Will Reduce Heavy Consumption Without Adversely Affecting Light And Moderate Consumers

N J Has Some Of The Highest Taxes In The Nation Except For Wine Survey Says Nj Com